income tax malaysia 2019 due date

The weighted average yield to maturity of a Funds investments in money market securities and. For any tax period prior to January 2018.

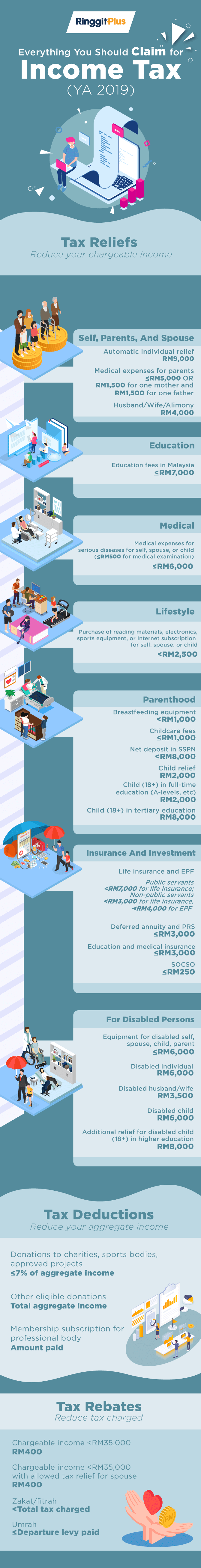

Malaysia Personal Income Tax Guide 2020 Ya 2019

Final in the sense that once an employer deducts PAYE from the gross salarywage of a particular employee it represents the final tax liability on that income.

. Effective from Year of Assessment 2020 this amendment is applicable to. There are virtually millions of. Lee the court ruled that there could be a corporate tax essentially saying the structure of business was a justifiably discriminatory criterion for governments to consider when writing tax legislation.

If the taxpayer does not pay tax due within 21 days of the notice the taxpayer will be regarded as a defaulter. In 2019 the total net government spending on healthcare was 36 billion or 123 of its GDP. As a result most employees will not be required to lodge Form S returns.

The higher the. Insurance is a means of protection from financial loss. This was a unique ruling handed down during a unique time in US history that denied a corporation freedom it sought in the courtroom.

The income tax rate for resident legal persons is 20 payment of 80 units of dividends triggers 20 units of tax due. I can see several of the family members visibly exhaling. Youll have to pay them before the due date which is.

Efiling Income Tax ReturnsITR is made easy with Clear platform. A marketplace or market place is a location where people regularly gather for the purchase and sale of provisions livestock and other goods. Top marginal tax rate of both individual 1 and corporate 2 income and total tax burden as a percentage of GDP 3.

Governments expenditures as a percentage of GDP including consumption and transfers. Advance payments are made in quarterly instalments. Business Income tax BIT and Corporate Income tax CIT filing for the income year 2019 was deferred until June 30 2020 and tax payments for tourism and related sectors hotel airlines and tour operators are.

This report highlights the progress being achieved to date on wait times pharmaceuticals management electronic health records teletriage and health innovation. Notification of Sources of Distribution. Oct 6 Los Angeles County gas prices break high record set in June.

Income Tax Slab for Financial Year 2019-20. The capital gains tax in 2011 was 28 on realized capital income. Net income P 190000 Tax due of P1M per tax table 15.

The introduction of income tax in Britain was due to the Napoleonic War in 1798. The capital gains tax in Finland is 30 on realized capital income and 34 if the realized capital income is over 30000 euros. Kenya Brazil whereas some middle-income countries have lower tax-to-GDP ratios eg.

The resident taxpayers are divided into three categories based on an individuals age. I A company resident and incorporated in Malaysia to be eligible for the tax. The deduction will be allowed next year if it is paid by the due date.

C P 2500000 Sales 200000 Add. The foreign tax credit cannot in any case exceed the net Italian tax due on the foreign source income. Public health care is financed by a special-purpose income tax on the order of 8.

This cycle is due to the periodic breakdown of the social structure of accumulation a set of institutions which secure and stabilize capital accumulation. Historically many taxation breakthroughs took place during wartime. Inland Revenue Board of Malaysia DATE OF ISSUE.

Compared to 24 in 2019 as Disney Netflix and. In different parts of the world a marketplace may be described as a souk from the Arabic bazaar from the Persian a fixed mercado or itinerant tianguis or palengke PhilippinesSome markets operate daily and are said to be. An entity which provides insurance is known as an insurer an insurance company an insurance carrier or an underwriterA person or entity who buys insurance is known as a policyholder while a person or entity.

2 billion will be provided to the Ministry of Health to meet health-related spending. A uniform Land tax originally was introduced in England during the late 17th century formed the main source of government revenue throughout the 18th century and the early 19th century. The income tax slab is a slab under which an individual fall is determined based on the income earned by an individual.

Tax paid and deducted is Rs. How free is a country from tax burden. Average Gannett salary 48k Gannett CEO income 77 million executives income 17 million someone who is good at the economy please help me budget this.

Otherwise if the income deriving from rented real estate owned outside of Italy is not subject to taxation in the foreign country the rental income reduced by 15 constitutes the taxable income in Italy. Under the TAL 2019 effective from 1st October 2019 the date for settling the final tax liability is within 21 days of the notice issued by the IRD. CORPORATE INCOME TAX SPECIAL CORPORATIONS True or False Part 1.

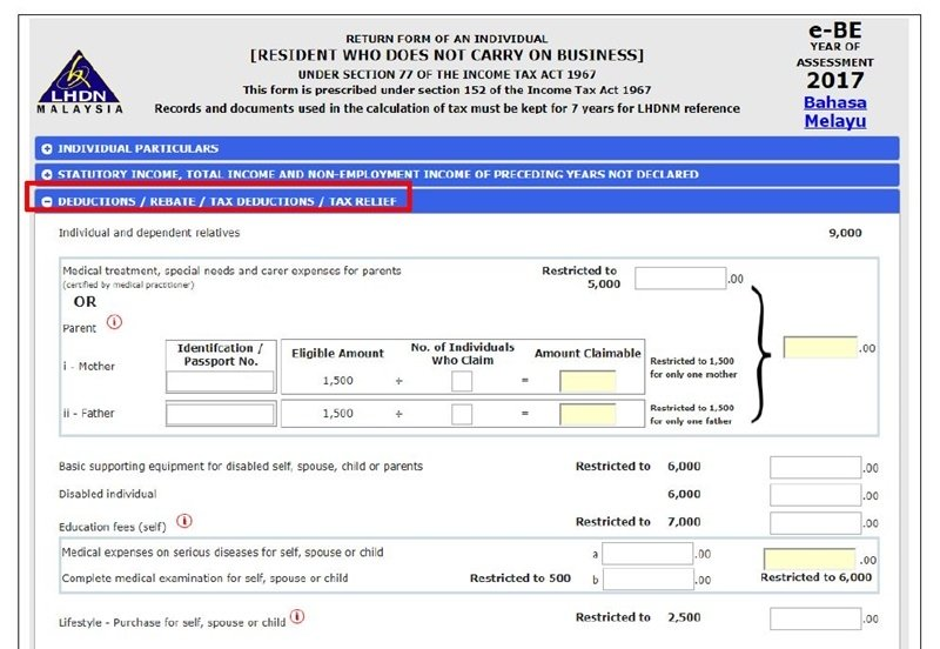

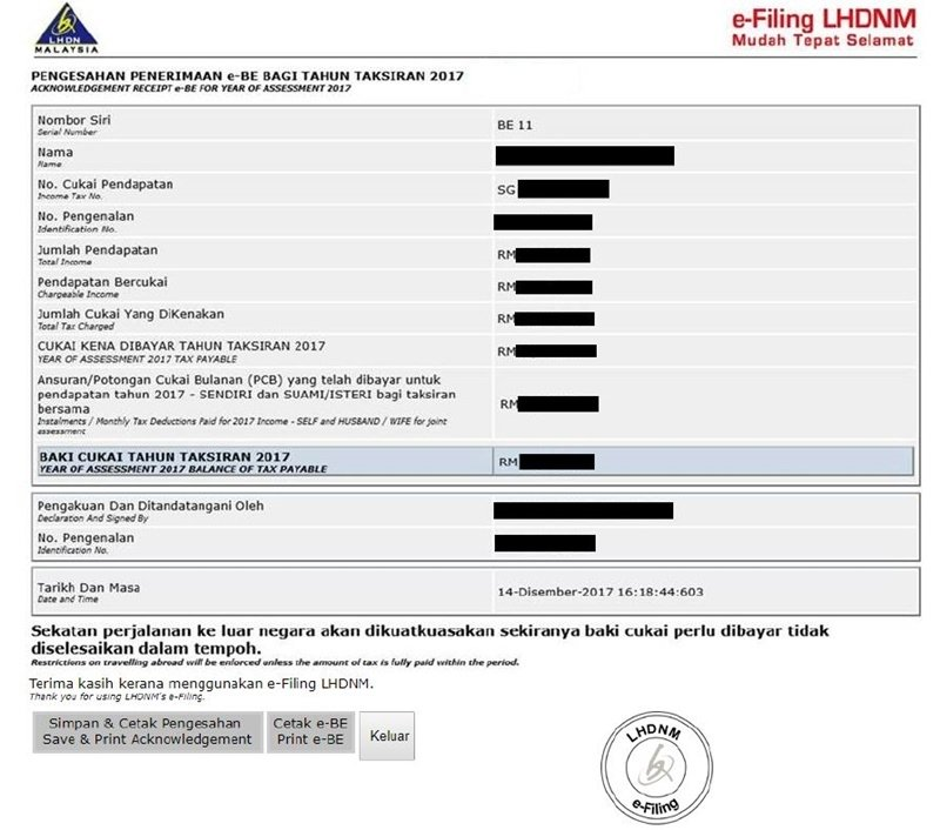

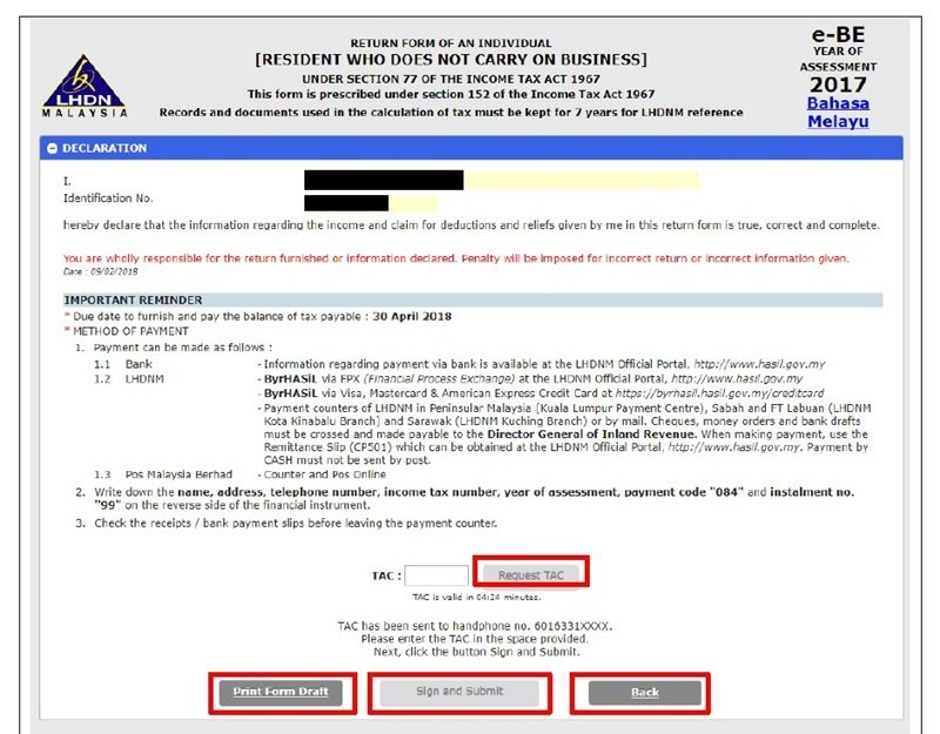

Section 43B- if the below-mentioned amounts are not paid before the last date for filing for an income tax return. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing. Taxation in Iran is levied and collected by the Iranian National Tax Administration under the Ministry of Finance and Economic Affairs of the Government of IranIn 2008 about 55 of the governments budget came from oil and natural gas revenues the rest from taxes and fees.

Other income P 2700000 Share in GPP net income 250000 Total sales and other income P 2450000 Less. In some cases the return after taxes may exceed the return before taxes due to an assumed tax benefit from any losses on a sale of fund shares at the end of the measurement period. Annual income exemption Total 8 Multiply by.

Just upload your form 16 claim your deductions and get your acknowledgment number online. This Practice Note is issued pursuant to the amendment of the Income Tax Act 1967 Act 53 ITA 1967 by the Finance Act 2019 Act 823. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing.

Income tax was announced in Britain by William Pitt the Younger in his budget of December 1798 and introduced in 1799 to pay for weapons and equipment in preparation. My newspaper is dying. Browse our listings to find jobs in Germany for expats including jobs for English speakers or those in your native language.

It comprises three quantitative measures. It is a form of risk management primarily used to hedge against the risk of a contingent or uncertain loss. P 196000 Tax due CHAPTER 15-A.

During the year 2019-2020 tax on rent has been deducted which was paid to Mr X. An additional resource of Nu. Attorneys fees will awarded at a later date.

The expansion of the Child Tax Credit was made for just one year and will be reduced back to 2000 per child in 2023. An estimated 50 of Irans GDP was exempt from taxes in FY 2004. Date of inversion start Date of the recession start Time from inversion to recession Start Duration of inversion.

Completely waived off 412018. This is because the correct amount. The WTO precursor General Agreement on Tariffs and Trade GATT was established by a multilateral treaty of 23 countries in 1947 after World War II in the wake of other new multilateral institutions dedicated to international economic cooperationsuch as the World Bank founded 1944 and the International Monetary Fund founded 1944 or 1945.

A 2019 study looking at the impact of tax cuts for. Individuals whose income is less than Rs25 lakh per annum are exempted from tax. Income is an essential determinant of the level of imported goods.

PAYE became a Final Withholding Tax on 1st January 2013. Tax paid after due date 18 per annum.

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

The Global Burden Of Cancer Attributable To Risk Factors 2010 19 A Systematic Analysis For The Global Burden Of Disease Study 2019 The Lancet

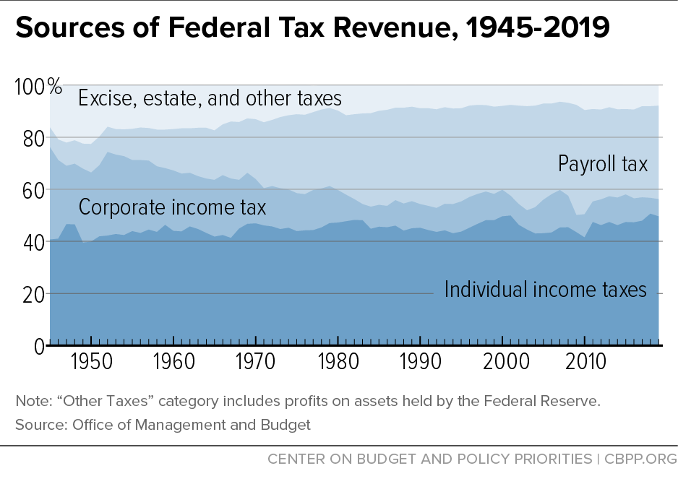

Policy Basics Where Do Federal Tax Revenues Come From Center On Budget And Policy Priorities

Malaysia Personal Income Tax Guide 2020 Ya 2019

Malaysia Personal Income Tax Guide 2020 Ya 2019

Income Tax Malaysia 2018 Mypf My

Income Tax Malaysia 2019 Deadline

2020 Tax Relief What To Claim For Your Tax Deductions R Malaysia

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Malaysia Personal Income Tax Guide 2020 Ya 2019

Malaysia Personal Income Tax Guide 2020 Ya 2019

Business Income Tax Malaysia Deadlines For 2021

Income Tax Malaysia 2018 Mypf My

Individual Income Taxes Urban Institute

28 Gunalan Associates Ideas Taxact Save Money Travel Best Success Quotes

Why It Matters In Paying Taxes Doing Business World Bank Group

Comments

Post a Comment